- Bottom line up 17% to Rs. 3.4 b; Rights proceeds boost interest income

- Core sectors except transportation improve performance

- First nine months Group revenue up 4% to Rs. 62 b; PBT up 2% to Rs. 9.1b; Bottom line up 1% to Rs. 7 b

Premier blue chip John Keells Holdings PLC (JKH) yesterday reported strong results for third quarter as all core sectors except transportation improved their performance and high interest income helping the bottom line.

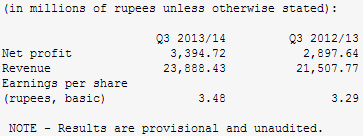

The Group revenues at Rs. 23.89 billion and Rs. 64.98 billion in the third quarter and the nine months ended 31 December 2013 were 11% and 4% above the Rs. 21.51 billion and Rs. 62.20 billion recorded in the corresponding periods in the previous year.

The Group revenues at Rs. 23.89 billion and Rs. 64.98 billion in the third quarter and the nine months ended 31 December 2013 were 11% and 4% above the Rs. 21.51 billion and Rs. 62.20 billion recorded in the corresponding periods in the previous year.

Results from operating activities grew by 30% to Rs. 2.64 billion in the 3Q and by 7% to Rs. 5.89 billion in the nine months.

The Group profit before tax (PBT) at Rs. 4.27 billion in the third quarter of the financial year 2013/14 was an increase of 19%. The Group PBT for the nine months ended 31 December 2013 of Rs. 9.11 billion was an increase of 2%.

Pre-tax profit figure was boosted by Rs. 1.26 billion net finance income up by 24% in the first quarter and Rs. 3.08 billion in nine months, up by 19%. This was largely on account of the increase in the cash balance arising from the proceeds of the rights issue which is earmarked for the ‘Waterfront’ Project.

The PBT for the nine months ended 31 December 2013, included a non-recurring charge of Rs. 139 million on account of the voluntary retirement scheme offered at Keells Food Products PLC, a non-cash charge of Rs. 144 million relating to the share based payments which came into effect in the current financial year and an impairment loss of Rs. 141 million arising from the demolition of buildings at Glennie Street and Justice Akbar Mawatha, totalling Rs. 424 million. The impact of these expenses on PBT for the quarter amounted to Rs. 211 million.

JKH’s bottom line – net profit attributable to equity holders of the parent was up 17% to Rs. 3.4 billion in 3Q and by 1% to Rs. 7.04 billion in the nine months.

JKH interim results were released after the market was closed but the stock was on the up anyway. JKH closed up 2% or Rs. 4.80 to Rs. 240.70 though on a surprisingly very thin volume of 28,493 shares.

Detailing sectoral performance JKH Chairman Susantha Ratnayake said the transportation industry group PBT of Rs. 538 million for the third quarter of 2013/14 was a decrease of 36% in comparison to the corresponding period in the previous financial year [2012/13 Q3: Rs. 844 million].

The decline in PBT is mainly attributable to the lower contribution from the ports and bunkering businesses. The ports business witnessed a drop in volumes as a result of the re-alignment of services experienced in the second quarter.

The Group’s bunkering business, although retaining market leadership in terms of share, recorded lower earnings compared to the same period last year as a result of the continued depression in the global bunker market coupled with the local and regional competition.

Leisure

The Leisure industry group PBT of Rs. 1.54 billion for the third quarter of 2013/14 was an increase of 15% compared to the corresponding period of the previous financial year [2012/13 Q3: Rs. 1.34 billion]. The increase in PBT was driven by the improved performance of Sri Lankan and Maldivian resorts compared to the previous year.

The performance of Sri Lankan resorts improved as a result of revised market positioning and implementation of effective yield management strategies which resulted in higher occupancies across the portfolio of hotels, whilst Maldivian resorts also benefitted from higher occupancies. The performance of city hotels and destination management continued to be in line with expectations.

Property

The property industry group PBT of Rs. 347 million for the third quarter of 2013/14 was a 93% increase over the PBT recorded in the corresponding period of the previous financial year [2012/13 Q3: Rs. 180 million]. The growth in PBT is on account of higher revenue recognition during the quarter in the ‘OnThree20’ development and the recognition of revenues from ‘7th Sense’ which had not commenced in the previous year. Construction of both developments are progressing as scheduled with approximately 90% of units of ‘OnThree20’ and 70% of ‘7th Sense’ sold to date.

Consumer foods and retail

The consumer food and retail industry group PBT of Rs. 228 million in the third quarter of 2013/14 was an increase of 23% over the PBT recorded in the corresponding period of the previous financial year [2012/13 Q3: Rs. 186 million]. Both the soft drinks and frozen confectionary segments recorded an increase in volumes.

Keells Food Products had a one off cost of Rs. 139 million during the quarter under review associated with the voluntary retirement scheme offered to its employees at the Ja-Ela plant in order to improve productivity and to make possible an internal restructuring of operations.

The retail business continued to witness same store sales growth on the back of increased footfall and basket values.

Financial services

The financial services industry group PBT of Rs. 1.01 billion in the third quarter of 2013/14 was an increase of 38% over the PBT recorded in the corresponding period of the previous financial year [2012/13 Q3: Rs. 734 million].

Both the insurance and banking businesses were the primary contributors to the improved performance. The implementation of the bank’s new positioning strategy was successfully concluded during the quarter under review.

As stipulated under the Insurance Industry Act No. 3 of 2011, the insurance business is in the process of making the necessary arrangements to segregate the life and general businesses by February 2015.

The stock brokering business gained market share despite the decrease in average daily turnovers as a consequence of the lower level of activity that prevailed on the Colombo Stock Exchange.

Information technology

The information technology industry group PBT of Rs. 87 million for the third quarter of 2013/14 was a decrease of 16% compared to the corresponding period of the previous financial year [2012/13 Q3: Rs. 103 million].

This decrease in PBT was largely on account of the software services business. The office automation business, which is the significant contributor towards the profits of the industry group, recorded a marginal decline in profits compared to the corresponding period in the previous year.

Other, including plantation services

Other, comprising of plantation services and the corporate centre recorded a PBT of Rs. 517 million in the third quarter of 2013/14 [2012/13 Q3:Rs. 194 million]. The increase in PBT was primarily attributable to an increase in net interest income at the company as a result of the increase in the cash balance arising from the proceeds of the rights issue which is earmarked for the ‘Waterfront’ Project.

The plantation sector also saw a significant improvement in its performance following improved quality of made tea, attractive prices and positive market conditions.

www.ft.lk