LBO – ICRA Lanka, a group company of Moody’s Investors Service is cognisant of the asset quality deterioration in licensed finance companies in Sri Lanka, during the financial year ended March 31, 2018.

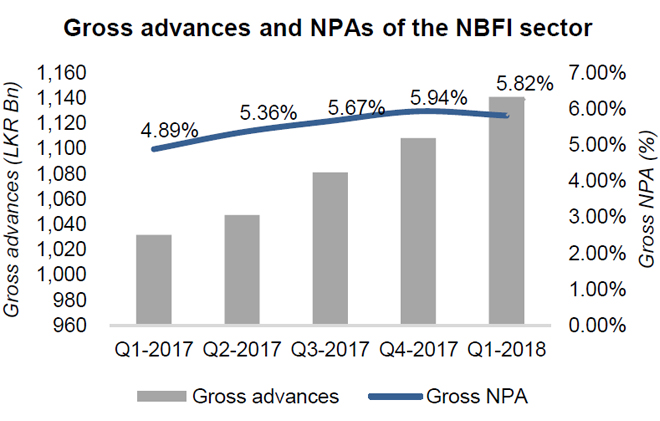

LBO – ICRA Lanka, a group company of Moody’s Investors Service is cognisant of the asset quality deterioration in licensed finance companies in Sri Lanka, during the financial year ended March 31, 2018.“As per our analysis about 100bps increase (5.82% in March 2018 vis-s-vis 4.89% in March 2017) in gross NPA (non-performing loans) levels during the period is attributable to a number of factors,” ICRA Lanka said in a statement.

The statement outlines overall slow-down in economic growth, particularly affecting lower tiers of the economy and adverse weather conditions that prevailed from the last quarter of 2016 to latter part of the year 2017 as those factors.

Particularly high NPAs in SME related lending: In the last couple of years, NBFIs were extensively growing their SME related lending portfolios, due to relatively better yields in SME lending and due challenging market dynamics in the traditional vehicle leasing segment. SME related loans are granted in the form of factoring, post-dated cheque discounting and short-term loans. However, we observe increasing slippages in these product segments of the SME portfolios as the macro conditions were challenging.

ICRA Lanka also observes a significant moderation in portfolio growth, in NBFIs that are involved in SME lending, as the focus has shifted towards recovery efforts of the same facilities.

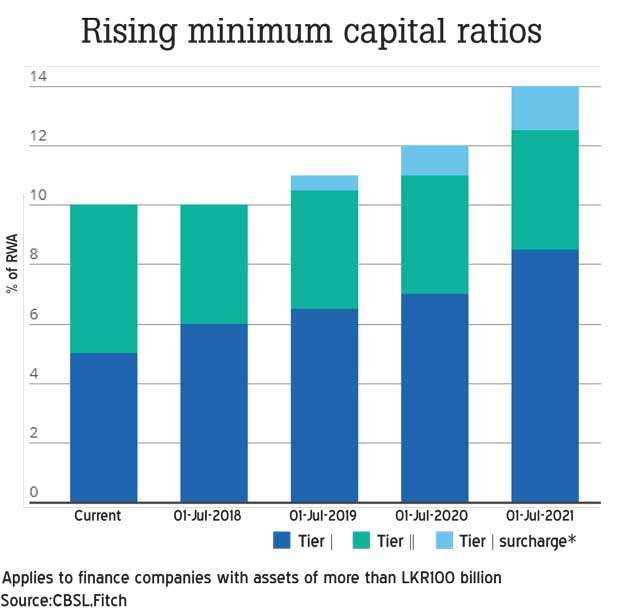

Further, according to new capital adequacy requirements (June 2018), risk weighting for unsecured lending has increased to 125 percent, which is expected to limit NBFIs’ exposure to the asset class, in view of maintaining healthy capitalization.

Asset quality in Micro-lending is also affected: As per ICRA Lanka’s observations, microlending (Grameen model group lending and other micro related lending) of the NBFI sector has grown by about 28% CAGR between the period FY2015 to FY2017. As per their estimates, aggregate microlending by licensed finance companies stood at about LKR 90-100Bn as in March 2017.

“Number of factors including the recent weather conditions affecting rural areas, as well as multiple lending is done by unregulated microfinance lenders has affected the credit quality dynamics of the segment, However, as per our observation, the NPAs of this segment (NBFI microlending) remains better than that of the SME segment of NBFIs,”

“Going forward, ICRA Lanka will continue to monitor the NPA movement of the rated NBFIs and specific rating actions will be announced accordingly.”