Reuters: ** Sri Lankan shares ended firmer at a more than one-week high on Friday buoyed by gains in beverage stocks, posting their first monthly gain this year, while the rupee edged up on dollar sales as month-end inward remittances surpassed importers’ greenback demand, market sources said.

** The benchmark stock index ended 0.51% firmer at 5,372.28, its highest close since June 20. The index rose 0.16% for the week and posted its first monthly gain since December, rising 1.15%. However, it is still down 11.24% so far this year.

** Foreigners sold on a net basis for the 14th session out of the last 15, the bourse data showed.

** Friday’s stock market turnover was 300.91 million rupees ($1.71 million), well below this year’s daily average of about 545.2 million rupees. Last year’s daily average was 834 million rupees.

** Foreign investors sold a net 54.9 million rupees worth of shares on Friday, extending the year-to-date net foreign outflow to 6.34 billion rupees.

** The currency edged up at 176.40/50 per dollar, compared with Thursday’s close of 176.55/65, market sources said. The rupee rose 0.17% during the week and is up 3.51% for the year.

** The island nation raised $2 billion via 5-year and 10-year sovereign bond sales, its central bank said on Tuesday, tapping global capital markets for the second time in three months.

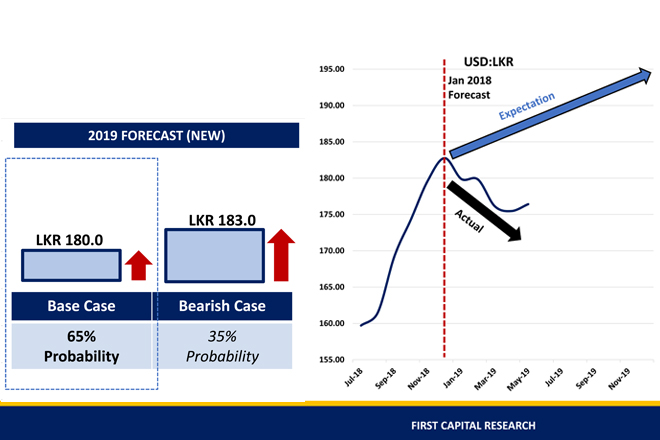

** But analysts expect the rupee to weaken further as money flows out of stocks and government securities.

** The rupee dropped 16% in 2018 and was one of the worst-performing currencies in Asia.

** Foreign investors bought a net 879.6 million rupees worth of government securities in the week ended June 19, but the island nation’s net foreign outflow was at 20.7 billion rupees so far this year, the central bank data showed.

** The central bank cut its key interest rates on May 31 to support a faltering economy as overall business and consumer confidence slumped following deadly bomb attacks in April.

** Sri Lanka is unlikely to hit its full-year economic growth target of 3-4% following the bombings, junior Finance Minister Eran Wickramaratne told Reuters last month. A Reuters poll has forecast growth to slump to its lowest in nearly two decades this year.

($1 = 176.4000 Sri Lankan rupees)

(Reporting by Ranga Sirilal and Shihar Aneez; Editing by Rashmi Aich)