Contributed by both food and non-food inflation, headline inflation, as measured by the year-on-year change in the Colombo Consumers’ Price Index (CCPI, 2013=100), increased to 5.5 per cent in January 2017 from 4.5 per cent in December 2016. Core inflation, based on CCPI, also accelerated to 7.0 per cent in January 2017 from 5.8 per cent in December 2016. Headline inflation and core inflation, based on the National Consumer Price Index (NCPI, 2013=100), which is available with a time lag, also reflected an upward trend in December 2016, recording 4.2 per cent and 6.7 per cent, respectively, on a year-on-year basis. In spite of the increase in inflation in recent times, which is mainly attributed to the impact of tax adjustments and the adverse weather conditions, inflation is projected to remain in mid-single digit levels, on average during the year supported by appropriate supply side and demand management policies.

Meanwhile, the year-on-year growth of credit extended to the private sector by commercial banks remained high at 21.9 per cent by end 2016. Although the growth of credit has somewhat eased from the peak of 28.5 per cent observed in July 2016, credit disbursements in absolute terms remain high in spite of the substantial upward adjustments in nominal and real interest rates. Mainly as a result of the growth of credit to the private and public sectors, broad money growth (M2b) remained at the elevated level of 18.4 per cent, on a year-on-year basis, at end 2016. It is anticipated that the growth of monetary and credit aggregates would gradually moderate during 2017, towards a level consistent with the anticipated real economic growth and mid-single digit inflation.

In the external sector, the cumulative deficit in the trade balance expanded further to US dollars 8.2 billion during the first eleven months of 2016 from US dollars 7.6 billion during the corresponding period in 2015, as a result of increased import expenditure, amidst the contraction in export earnings. Earnings from tourism and workers’ remittances continued to dampen the adverse impact of the trade deficit on the overall balance of payments. Earnings from tourism were estimated to have increased by 14.0 per cent to around US dollars 3.4 billion during 2016, while workers’ remittances increased by 3.7 per cent to US dollars 7.2 billion during the year. The realisation of foreign direct investment (FDI) inflows was below expectations in the first nine months of the year, while there were some outflows of foreign investments from the rupee denominated government securities market. Gross official reserves were estimated at US dollars 5.5 billion by end January 2017 compared to US dollars 6.0 billion by end 2016. Reflecting the developments in the external sector, the Sri Lankan rupee, which depreciated by 3.8 per cent against the US dollar in 2016, depreciated further by 0.5 per cent thus far during 2017.

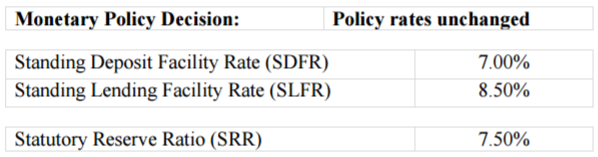

Considering the above, the Monetary Board, at its meeting held on 06 February 2017, was of the view that the economy is gradually responding to the stabilisation measures adopted by the Central Bank and the government since late 2015. However, close monitoring of macroeconomic developments is necessary in the period ahead, with a view to adopting further corrective measures, if required. The Board was also of the view that, at this stage, the monetary policy stance of the Central Bank is appropriate and decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank unchanged at 7.00 per cent and 8.50 per cent, respectively.

Meanwhile, the year-on-year growth of credit extended to the private sector by commercial banks remained high at 21.9 per cent by end 2016. Although the growth of credit has somewhat eased from the peak of 28.5 per cent observed in July 2016, credit disbursements in absolute terms remain high in spite of the substantial upward adjustments in nominal and real interest rates. Mainly as a result of the growth of credit to the private and public sectors, broad money growth (M2b) remained at the elevated level of 18.4 per cent, on a year-on-year basis, at end 2016. It is anticipated that the growth of monetary and credit aggregates would gradually moderate during 2017, towards a level consistent with the anticipated real economic growth and mid-single digit inflation.

In the external sector, the cumulative deficit in the trade balance expanded further to US dollars 8.2 billion during the first eleven months of 2016 from US dollars 7.6 billion during the corresponding period in 2015, as a result of increased import expenditure, amidst the contraction in export earnings. Earnings from tourism and workers’ remittances continued to dampen the adverse impact of the trade deficit on the overall balance of payments. Earnings from tourism were estimated to have increased by 14.0 per cent to around US dollars 3.4 billion during 2016, while workers’ remittances increased by 3.7 per cent to US dollars 7.2 billion during the year. The realisation of foreign direct investment (FDI) inflows was below expectations in the first nine months of the year, while there were some outflows of foreign investments from the rupee denominated government securities market. Gross official reserves were estimated at US dollars 5.5 billion by end January 2017 compared to US dollars 6.0 billion by end 2016. Reflecting the developments in the external sector, the Sri Lankan rupee, which depreciated by 3.8 per cent against the US dollar in 2016, depreciated further by 0.5 per cent thus far during 2017.

Considering the above, the Monetary Board, at its meeting held on 06 February 2017, was of the view that the economy is gradually responding to the stabilisation measures adopted by the Central Bank and the government since late 2015. However, close monitoring of macroeconomic developments is necessary in the period ahead, with a view to adopting further corrective measures, if required. The Board was also of the view that, at this stage, the monetary policy stance of the Central Bank is appropriate and decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank unchanged at 7.00 per cent and 8.50 per cent, respectively.

No comments:

Post a Comment