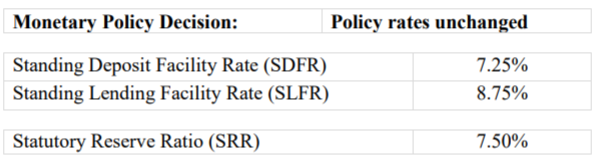

Considering developments and outlook in the domestic and international macroeconomic environment, the Monetary Board, at its meeting held on 25 September 2017, was of the view that the current monetary policy stance is appropriate and decided to maintain the policy interest rates of the Central Bank of Sri Lanka at their present levels.

Given below are the key factors that the Monetary Board considered in arriving at the decision.

According to the provisional estimates of the Department of Census and Statistics (DCS), the Sri Lankan economy expanded at the moderate pace of 4.0 per cent, year-on-year, in the second quarter of 2017, in comparison to 3.8 per cent year-on-year growth in the first quarter of 2017. Economic growth continued to be affected by extreme weather conditions and weak external demand. In terms of value addition, key growth drivers in the first half of the year were construction, mining and quarrying, financial service activities, and wholesale and retail trade. Although disruptions to near term growth prospects continue, forward looking indicators show improved medium term prospects, which are likely to be realised with the envisaged structural reforms and expected inflows of foreign investments.

Headline inflation based on both Colombo Consumer Price Index (CCPI, 2013=100) and National Consumer Price Index (NCPI, 2013=100) increased in August 2017, reflecting the base effect of tax revisions as well as higher prices of food items. Core inflation, based on both CCPI and NCPI also recorded an uptick in August 2017. Nevertheless, projections indicate that inflation will revert to the envisaged mid-single digit levels by end 2017 and stabilise thereafter, underpinned by tight monetary conditions that have been in place from the beginning of 2016.

The growth of credit extended to the private sector by commercial banks has shown a gradual deceleration since July 2016, responding to the prevailing high nominal and real interest rates in the domestic market. So far during the year, net credit extended to the government (NCG) by the Central Bank has declined sharply, although NCG by the banking sector has been high. A moderate expansion of credit to public corporations has also been observed during the year. However, the expansion in the net foreign assets (NFA) of the banking sector, as a result of the buildup of NFA of the Central Bank and the reduction in foreign liabilities of commercial banks, caused broad money (M2b) growth to remain at elevated levels. Meanwhile, deposit and lending rates appear to have stabilised, partly in response to the recent decline in yields on government securities.

In the external sector, earnings from exports maintained its positive growth for the fifth consecutive month in July 2017. However, the cumulative trade deficit widened in July 2017 as a result of the rise in import expenditure, partly attributed to weather related disruptions to power generation and food production. Tourist arrivals and associated foreign exchange inflows grew on a cumulative basis. Workers’ remittances also increased in July 2017, although declining on a cumulative basis during the year owing to sluggish economic performance and geo-political uncertainties in the Middle East. The rupee denominated government securities market and the Colombo Stock Exchange (CSE) continued to attract foreign inflows. Amidst these developments, the Central Bank cumulative purchases of foreign exchange from the domestic market exceeded US dollars 1.1 billion on a net basis, and gross official reserves improved to around US dollars 7.3 billion by 21 September 2017 from US dollars 6.0 billion at end 2016. With increased flexibility in the determination of the exchange rate, the pressure in the domestic foreign exchange market has eased considerably, resulting in a cumulative depreciation of the Sri Lankan Rupee against the US dollar by 2.0 per cent up to 22 September 2017, in comparison to the depreciation of 3.8 per cent observed in 2016.

In view of the above, the Monetary Board decided to maintain the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 7.25 per cent and 8.75 per cent, respectively.

The release of the next regular statement on monetary policy will be on 07 November 2017.

No comments:

Post a Comment