COLOMBO, Jan 29 (Reuters) - Sri Lankan shares rose on Wednesday, led by conglomerate John Keells Holdings, and as local institutions bought stocks after interest rates dropped though foreign investors sold risky assets ahead of a U.S. Federal Reserve decision on trimming stimulus.

The main stock index gained 0.54 percent, or 33.31 points, to 6,252.14, near its highest close since June 12 hit on Friday. Interest rates in treasury bills eased at a weekly auction on Wednesday to multi-year lows, making fixed-income assets unattractive for investors.

"Now we see some local institutions buying shares when foreigners are selling. We didn't see that up to now. Gradually local (investor) confidence is building up," said a stockbroker on condition of anonymity.

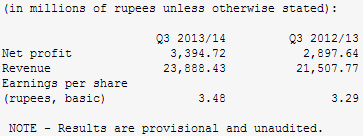

Shares in John Keells Holdings rose 2.03 percent. The company said after market close that its December-quarter net profit rose 17 percent year-on-year to 3.39 billion rupees.

Sri Lanka's only specialised Islamic bank, Amana, which started trading for the first time on Wednesday, ended at 5.90 rupees, 15.7 percent lower than its IPO price of 7 rupees.

Foreign investors were net sellers of 18.77 million rupees ($143,500) worth of shares, but have been net buyers of 1.04 billion rupees so far this year.

They had bought 22.88 billion rupees of stocks last year.

The index has gained 5.2 percent in the last 15 sessions, including last week's 2 percent gain, which analysts attributed to the central bank's rate cut on Jan. 2 and the recent fall in T-bill yields.

The index has been in an overbought region since Jan. 7, Thomson Reuters data shows.

It has risen 5.7 percent so far this year, following a 4.8 percent gain in 2013, after having fallen in the previous two years.

The day's turnover was 808 million rupees, less than last year's daily average of about 828.4 million rupees.

($1 = 130.8250 Sri Lanka rupees)

(Reporting by Ranga Sirilal and Shihar Aneez; Editing by Anupama Dwivedi)