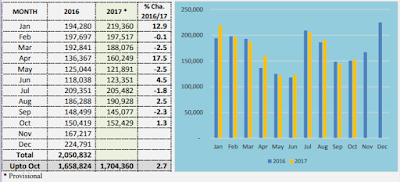

Tourist arrivals to Sri Lanka rose 1.3 percent from a year earlier to 152,429 in October 2017. In the first ten months arrivals rose 2.7 percent to 1,704,360.

India remained the main market in October 2017 with 36996 arrivals followed by China,Uk and Germany.

Tourist Arrivals by Region

Tourist Arrivals by Country of Residence - Top Ten Countries