Reuters: Sri Lankan shares rose on Tuesday, recovering from a more than 10-month closing low hit in the previous session, as investors picked up battered blue chips after the central bank held its key policy rates steady, brokers said.

However, concerns over rising market interest rates continued to weigh on sentiment, they added.

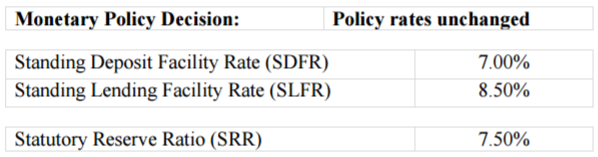

The central bank kept its key rates steady for a sixth straight month, but flagged possible "corrective measures" in the months ahead in a sign further tightening might be on the cards to temper inflation pressures and safeguard a fragile rupee.

The Colombo stock index ended 0.4 percent firmer at 6,093.04, snapping two consecutive sessions of declines.

Bargain-hunting was seen in the later part of the session with investors picking up blue chips, said Dimantha Mathew, head of research at First Capital Equities (Pvt) Ltd.

Sri Lankan stocks, which have been declining since October, have been hurt by political uncertainty arising from a decision of the ruling coalition parties to contest local polls separately, and on worries over a rise in market interest rates.

Yields on treasury bills rose 2-8 basis points at a weekly auction on Tuesday.

Market turnover was 500.4 million rupees ($3.33 million), less than this year's daily average of 620.7 million rupees.

Foreign investors, who have been net sellers of 1.18 billion rupees worth of shares so far this year, net bought 110.6 million rupees worth of equities on Tuesday.

Shares of John Keells Holdings Plc rose 1.20 percent, Nestle Lanka Plc gained 2.56 percent and Sri Lanka Telecom Plc climbed 3.53 percent.

Hemas Holdings Plc gained 2.92 percent, Dialog Axiata Plc climbed 0.96 percent and Ceylon Tobacco Company Plc rose 0.36 percent.

However, concerns over rising market interest rates continued to weigh on sentiment, they added.

The central bank kept its key rates steady for a sixth straight month, but flagged possible "corrective measures" in the months ahead in a sign further tightening might be on the cards to temper inflation pressures and safeguard a fragile rupee.

The Colombo stock index ended 0.4 percent firmer at 6,093.04, snapping two consecutive sessions of declines.

Bargain-hunting was seen in the later part of the session with investors picking up blue chips, said Dimantha Mathew, head of research at First Capital Equities (Pvt) Ltd.

Sri Lankan stocks, which have been declining since October, have been hurt by political uncertainty arising from a decision of the ruling coalition parties to contest local polls separately, and on worries over a rise in market interest rates.

Yields on treasury bills rose 2-8 basis points at a weekly auction on Tuesday.

Market turnover was 500.4 million rupees ($3.33 million), less than this year's daily average of 620.7 million rupees.

Foreign investors, who have been net sellers of 1.18 billion rupees worth of shares so far this year, net bought 110.6 million rupees worth of equities on Tuesday.

Shares of John Keells Holdings Plc rose 1.20 percent, Nestle Lanka Plc gained 2.56 percent and Sri Lanka Telecom Plc climbed 3.53 percent.

Hemas Holdings Plc gained 2.92 percent, Dialog Axiata Plc climbed 0.96 percent and Ceylon Tobacco Company Plc rose 0.36 percent.

($1 = 150.4000 Sri Lankan rupees)

(Reporting by Ranga Sirilal; Editing by Subhranshu Sahu)