Click here to read the Full Report (LBO) – Sri Lanka’s external reserves have fallen to a 6.9 year low after country’s reserves dropped almost 9 percent to 5.12 billion US dollars in March 2017, a research note showed. Central Bank has purchased 192.23 million dollars of foreign exchange from commercial banks at market rates in March while selling just 13 million dollars in the month.

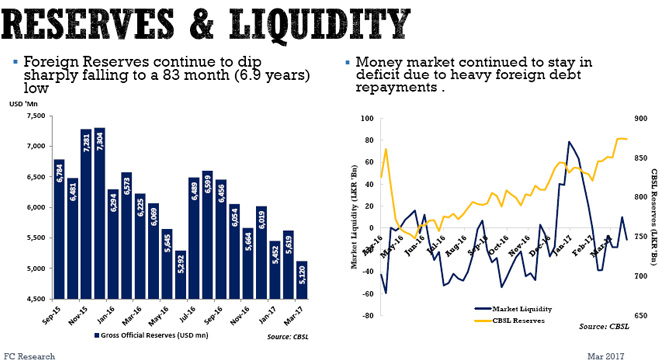

Click here to read the Full Report (LBO) – Sri Lanka’s external reserves have fallen to a 6.9 year low after country’s reserves dropped almost 9 percent to 5.12 billion US dollars in March 2017, a research note showed. Central Bank has purchased 192.23 million dollars of foreign exchange from commercial banks at market rates in March while selling just 13 million dollars in the month.Foreign currency reserves dipped 11 percent to 4.16 billion US dollars and reserves in Gold were 0.89 billion US dollars.

Central Bank’s Treasury bill holdings were up from 211.32 billion rupees in February to 233.32 billion rupees in March.

First Capital said in a research note that the sudden increase in the market liquidity towards the latter part of the month and renewed foreign and local buying interest resulted in yields dipping by 10-25bps specifically in the 2 year to 15 year bonds.

“Amidst the increasing activity, some selling pressure was observed during the last week of the month creating an overall net foreign outflow of 0.42 billion rupees in March 2017.”

“In spite of mid-long tenure yields dipping, a jump in the short tenure was observed.”

During the year up to 12 April 2017, Sri Lanka rupee has depreciated against the US dollar by 1.2 percent.

First Capital Holdings further highlighted that the money market continued to stay in deficit due to heavy foreign debt repayments.