Says would be liable to pay a total of Rs.847.3 million as Super Gains Tax

Chevron Lubricants Lanka PLC, the local unit of US-based multi national saw its net profit for the quarter ended March 31, 2015 (1Q15) falling Rs.210 million amid subdued top line growth, the interim financial accounts released to the Colombo Stock Exchange showed.

Chevron Lubricants Lanka PLC, the local unit of US-based multi national saw its net profit for the quarter ended March 31, 2015 (1Q15) falling Rs.210 million amid subdued top line growth, the interim financial accounts released to the Colombo Stock Exchange showed.

The earnings per share deteriorated to Rs.6.19 from Rs.6.36. The revenue for the quarter under review fell by Rs.177 million to Rs.2.81 billion while the gross profit fell to Rs.1.19 billion from previous year’s Rs.1.24 billion despite a considerable fall in cost of sales from Rs.1.74 billion to Rs.1.161 billion.

The administrative expenses also edged down to Rs.108 million from Rs.115 million.

The finance income fell to Rs.28.7 million from Rs.45 million.

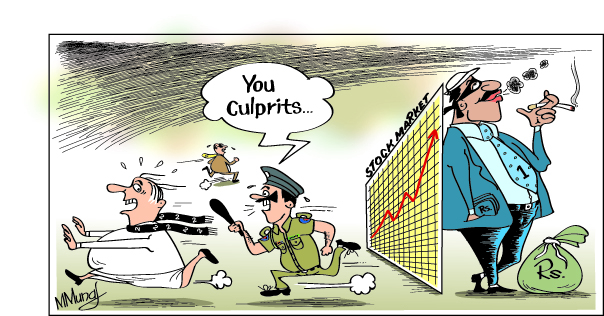

The company said it would be liable to pay a total of Rs.847.3 million as Super Gains Tax in three equal installments in May, July and September if the Draft Act gazetted by the government for the imposition of the tax is enacted by Parliament.

However Chevron Lubricants Lanka said it had not provided for the liability. The company has announced Rs.5 per share as first interim dividend.

www.dailymirror.lk