Sri Lanka’s new vehicles registrations have surged to a new high of 611,551 up to November this year compared to 371,906 in the same period last year, Sri Lanka Motor Traffic Department data showed.The demand for vehicles has increased mainly from state sector employees who benefited from the government pay hike and the interest rate reduction on bank and finance company loans and leasing facilities, a top official of the Motor Traffic Department (MTD) revealed.

Vehicle registrations recorded a an increase to 63,824 in September 2015 from 40,573 in the same month last year, but fell from a record 66,889 set in March ,MTD data showed.The increase in vehicle sales in September was possibly due to the confusion over the loan-to-value (LTV) ratio for vehicle leasing set by the Central Bank, MTD official said.”It is evident that the LTV rule has had a major impact on three-wheelers where volumes dropped from around 12,000 in September to 8,000 In October this year,” he added.

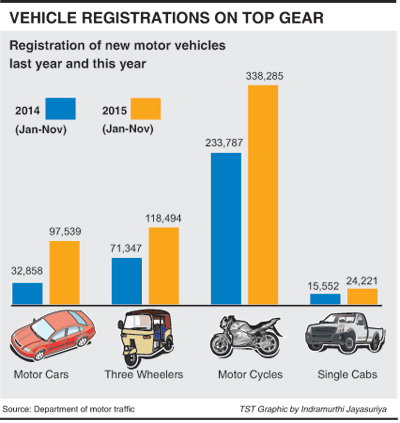

Even though the 70 percent LTV cap was announced on September 15 to come into effect for letters of credit opened after October 18, the Central Bank later said that it will come into effect only after December 1.Customers in large number have obtained 90 per cent leasing facility from those companies, before the 70 percent LTV come into effect to buy cars, three wheelers and motor cycles to beat the dead line.97,539 cars have been registered up to November this year; up from 32,858 in the same period last year

Registrations of three wheelers also recoded a new high of 118,494 up to November in 2015 compared to 71,347 up to November 2014. Registrations of motorcycles recorded an increase 338,285 up to November compared to 23,3787in the same period of 2014.Rajapaksa regime’s motor cycle distribution programme for public sector workers including the police has contributed immensely towards the increasing of motor cycle registrations in 2014 and 2015.

www.sundaytimes.lk