Both headline and core inflation, measured on a year-on-year basis, edged down in July 2016. The normalisation observed in domestic supply conditions as well as the suspension of the revisions made to certain taxes moderated consumer price inflation. However, the underlying upward trend in inflation, as reflected in annual average price changes, appears to have continued thus far during the year.

On the external front, the deficit in the trade account is estimated to have expanded by 2.2 per cent during the first half of 2016, on a year-on-year basis, as external demand remained relatively weak. Earnings from tourism were estimated to have increased by around 16.7 per cent during the period from January to July 2016, with a record number of tourist arrivals during the month of July. Workers’ remittances increased by 3.8 per cent during the first seven months of the year. These inflows, coupled with the renewed foreign interest in investments in government securities and the realisation of medium to long term financial flows to the government, eased the pressure on the balance of payments and the exchange rate. Meanwhile, gross official reserves were estimated to have improved to US dollars 6.5 billion by end July 2016 from US dollars 5.3 billion in end June 2016.

Monetary expansion remained high in the month of June 2016. Credit granted to the private sector by commercial banks continued to increase at a significantly high rate of 28.2 per cent in June 2016, on a year-on-year basis, in comparison to 28.0 per cent recorded in the previous month. A high intake of credit to the Industry and Services sectors together with a substantial growth in personal loans and advances drove the credit expansion during the first half of the year. Reflecting these developments, the growth of broad money (M2b) accelerated to 17.0 per cent in the month of June 2016 from 16.5 per cent recorded in the previous month. According to the available indicators, the high growth of private sector credit and broad money has continued in to the month of July 2016 as well. In the meantime, short term interest rates increased considerably in response to monetary tightening measures adopted by the Central Bank during the first seven months of the year, leading to a sharp upward adjustment in both lending and deposit rates in the financial sector.

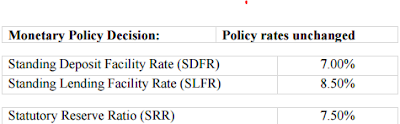

The Monetary Board, at its meeting held on 30 August 2016, observed that the impact of the policy measures adopted during the first seven months of the year through increasing policy interest rates and the Statutory Reserve Ratio (SRR) is being transmitted to the economy gradually. As such, the growth in monetary and credit aggregates is likely to decelerate during the remainder of the year to a level supportive of maintaining mid-single digit inflation in the medium term. Accordingly, the Monetary Board decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank unchanged at 7.00 per cent and 8.50 per cent, respectively.

On the external front, the deficit in the trade account is estimated to have expanded by 2.2 per cent during the first half of 2016, on a year-on-year basis, as external demand remained relatively weak. Earnings from tourism were estimated to have increased by around 16.7 per cent during the period from January to July 2016, with a record number of tourist arrivals during the month of July. Workers’ remittances increased by 3.8 per cent during the first seven months of the year. These inflows, coupled with the renewed foreign interest in investments in government securities and the realisation of medium to long term financial flows to the government, eased the pressure on the balance of payments and the exchange rate. Meanwhile, gross official reserves were estimated to have improved to US dollars 6.5 billion by end July 2016 from US dollars 5.3 billion in end June 2016.

Monetary expansion remained high in the month of June 2016. Credit granted to the private sector by commercial banks continued to increase at a significantly high rate of 28.2 per cent in June 2016, on a year-on-year basis, in comparison to 28.0 per cent recorded in the previous month. A high intake of credit to the Industry and Services sectors together with a substantial growth in personal loans and advances drove the credit expansion during the first half of the year. Reflecting these developments, the growth of broad money (M2b) accelerated to 17.0 per cent in the month of June 2016 from 16.5 per cent recorded in the previous month. According to the available indicators, the high growth of private sector credit and broad money has continued in to the month of July 2016 as well. In the meantime, short term interest rates increased considerably in response to monetary tightening measures adopted by the Central Bank during the first seven months of the year, leading to a sharp upward adjustment in both lending and deposit rates in the financial sector.

The Monetary Board, at its meeting held on 30 August 2016, observed that the impact of the policy measures adopted during the first seven months of the year through increasing policy interest rates and the Statutory Reserve Ratio (SRR) is being transmitted to the economy gradually. As such, the growth in monetary and credit aggregates is likely to decelerate during the remainder of the year to a level supportive of maintaining mid-single digit inflation in the medium term. Accordingly, the Monetary Board decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank unchanged at 7.00 per cent and 8.50 per cent, respectively.