Reuters: Sri Lankan shares closed at a more than one-week high on Monday as investor sentiment remained upbeat following approval of a key loan by the International Monetary Fund, but concerns over rising interest rates and foreign fund outflows capped gains.

The IMF's executive board approved a three-year, $1.5 billion loan to support Sri Lanka's economic reform agenda, the global lender said on June 4.

Treasury bill yields have risen between 16 and 36 basis points to near three-year highs in the last three weekly auctions through Wednesday despite the central bank leaving key policy rates steady for a third straight month on May 20.

Stockbrokers said a rise in interest rates could be detrimental to risky assets if they jumped beyond 12 percent. The average prime lending rate edged up 8 basis points to 10.23 percent in the week ended June 3.

The benchmark Colombo stock index ended 0.12 percent higher at 6,538.25, its highest close since June 1. The bourse gained 0.17 percent last week, snapping a three-week losing streak.

"Slow upward trend is continuing with the positive sentiment created after the IMF deal, but high interest rates are impacting the investor confidence," said Dimantha Mathew, head of research at First Capital Equities (Pvt) Ltd.

"Today, the turnover was pushed up by some block deals."

Turnover stood at 608.3 million rupees ($4.21 million), the highest since June 3, but still less than this year's daily average of around 771.6 million rupees.

Overseas funds offloaded a net 111.1 million rupees worth of shares on Monday, extending the year to date net foreign investor outflow to 5.84 billion rupees worth of equities.

Prime Minister Ranil Wickremesinghe told parliament last week that the government would take measures to abolish the Exchange Control Act and introduce a capital gains tax soon, without giving any time frame.

Shares in Carson Cumberbatch Plc jumped 5.34 percent, while Ceylon Cold Stores Plc rose 2.50 percent and Asiri Hospital Holdings Plc climbed 1.97 percent.

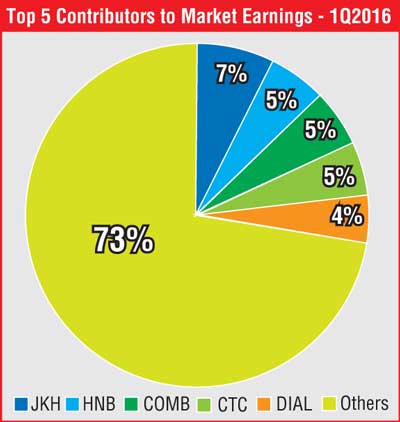

Conglomerate John Keells Holdings Plc was up 0.82 percent.

The IMF's executive board approved a three-year, $1.5 billion loan to support Sri Lanka's economic reform agenda, the global lender said on June 4.

Treasury bill yields have risen between 16 and 36 basis points to near three-year highs in the last three weekly auctions through Wednesday despite the central bank leaving key policy rates steady for a third straight month on May 20.

Stockbrokers said a rise in interest rates could be detrimental to risky assets if they jumped beyond 12 percent. The average prime lending rate edged up 8 basis points to 10.23 percent in the week ended June 3.

The benchmark Colombo stock index ended 0.12 percent higher at 6,538.25, its highest close since June 1. The bourse gained 0.17 percent last week, snapping a three-week losing streak.

"Slow upward trend is continuing with the positive sentiment created after the IMF deal, but high interest rates are impacting the investor confidence," said Dimantha Mathew, head of research at First Capital Equities (Pvt) Ltd.

"Today, the turnover was pushed up by some block deals."

Turnover stood at 608.3 million rupees ($4.21 million), the highest since June 3, but still less than this year's daily average of around 771.6 million rupees.

Overseas funds offloaded a net 111.1 million rupees worth of shares on Monday, extending the year to date net foreign investor outflow to 5.84 billion rupees worth of equities.

Prime Minister Ranil Wickremesinghe told parliament last week that the government would take measures to abolish the Exchange Control Act and introduce a capital gains tax soon, without giving any time frame.

Shares in Carson Cumberbatch Plc jumped 5.34 percent, while Ceylon Cold Stores Plc rose 2.50 percent and Asiri Hospital Holdings Plc climbed 1.97 percent.

Conglomerate John Keells Holdings Plc was up 0.82 percent.

($1 = 144.6500 Sri Lankan rupees)

(Reporting by Ranga Sirilal and Shihar Aneez; Editing by Biju Dwarakanath)