Reuters: Sri Lankan shares closed at a one-week high on Thursday, as investors bought banking stocks and continued foreign buying in the market underpinned positive sentiment, brokers said.

The Colombo stock index ended 0.2 percent up at 6,419.47, its highest close since Sept. 21.

Foreign investors bought a net 110.5 million rupees ($721,986) worth of shares on Thursday extending the year-to-date net foreign inflow to 17.8 billion rupees worth of equities.

Turnover stood at 801 million rupees, compared with this year’s daily average of about 915.5 million rupees.

“The market is up on continued foreign buying with healthy turnover levels,” said Hussain Gani, deputy CEO of Softlogic Stockbrokers, adding local retail investors also bought into the market.

Shares of the biggest listed lender Commercial Bank of Ceylon Plc ended 0.6 percent higher, while Lion Brewery Plc rose 6.6 percent, and Melstacorp Ltd ended 1.4 percent firmer.

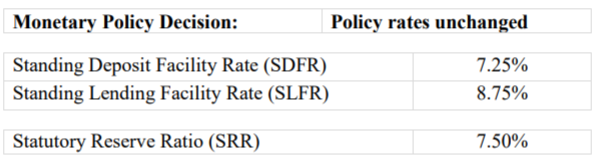

On Tuesday, the Sri Lankan central bank held its key rates steady, saying past steps were keeping inflation and credit growth under control, as policymakers focus on supporting an economy hit by extreme weather.

The Colombo stock index ended 0.2 percent up at 6,419.47, its highest close since Sept. 21.

Foreign investors bought a net 110.5 million rupees ($721,986) worth of shares on Thursday extending the year-to-date net foreign inflow to 17.8 billion rupees worth of equities.

Turnover stood at 801 million rupees, compared with this year’s daily average of about 915.5 million rupees.

“The market is up on continued foreign buying with healthy turnover levels,” said Hussain Gani, deputy CEO of Softlogic Stockbrokers, adding local retail investors also bought into the market.

Shares of the biggest listed lender Commercial Bank of Ceylon Plc ended 0.6 percent higher, while Lion Brewery Plc rose 6.6 percent, and Melstacorp Ltd ended 1.4 percent firmer.

On Tuesday, the Sri Lankan central bank held its key rates steady, saying past steps were keeping inflation and credit growth under control, as policymakers focus on supporting an economy hit by extreme weather.

($1 = 153.0500 Sri Lankan rupees)

(Reporting by Ranga Sirilal and Shihar Aneez; Editing by Amrutha Gayathri)