GWP up 11.73% to Rs. 55 billion as against a mere 3% improvement in 1H of 2014

The insurance industry has grown by 11.73% in terms of Gross Written Premium (GWP) to Rs. 55 billion as against a mere 3.07% improvement in the same period of last year.

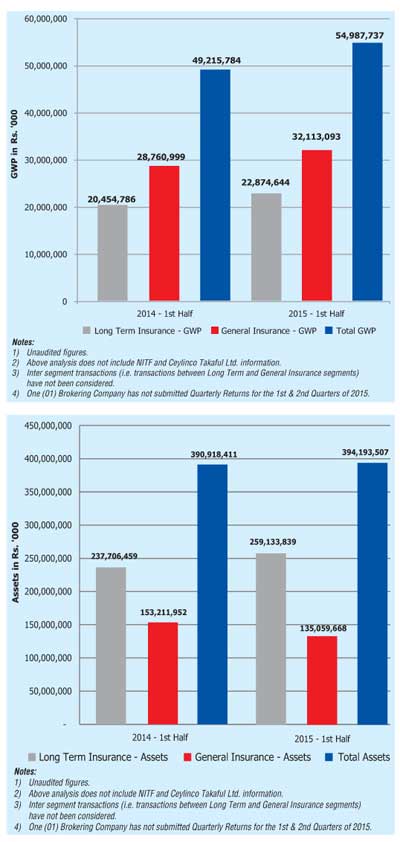

Insurance Board of Sri Lanka (IBSL) said yesterday that the GWP for Long Term Insurance and General Insurance Businesses for the six months up to 30 June 2015 was Rs. 54,988 million compared to the first six months of 2014 amounting to Rs. 49,216 million.

The GWP of General Insurance Business amounted to Rs. 32,113 million (1st half 2014: Rs. 28,761 million) while the GWP of Long Term Insurance Business amounted to Rs. 22,875 million (1st Half 2014: Rs. 20,455 million) during the first half of 2015. General Insurance Business and Long Term Insurance Business witnessed a GWP growth of 11.66% and 11.83% respectively when compared to the corresponding period of year 2014.

Total assets of insurance companies have increased to Rs. 394,193 million as at 30 June 2015 when compared to Rs. 390,918 million recorded as at 30 June 2014, reflecting a growth of 0.84%. This growth rate is significantly low when compared to the growth experienced in 1st Half of 2014, i.e. 13.0%. This is mainly due to the decline in the assets of General Insurance Business.

The assets of Long Term Insurance Business amounted to Rs. 259,134 million (1st half 2014: Rs. 237,706 million) indicating a growth rate of 9.01% year-on-year. The assets of General Insurance Business amounted to Rs. 135,060 million (1st half 2014: Rs. 153,212 million) depicting a negative growth rate of -11.85%, at the end of first six months of 2015.

At the end of first six months of 2015, investment in Government debt securities amounted to Rs. 120,503 million representing 46.50% (1st Half 2014: Rs. 106,192; 44.67%) of the total assets of long term insurance business, while such investment of the total assets of general insurance business amounted to Rs. 29,312 million representing 21.70% (1st half of 2014: Rs. 28,491; 18.60%). Accordingly, the total investment of assets of both technical reserve of general insurance business and long term insurance fund of the life insurance business amounted to Rs. 149,816 million representing 38.01% (1st Half of 2014: Rs. 134,683; 34.45%) as at 30 June 2015.

IBSL, under its overall objective of safeguarding the interests of policyholders, inquires into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. IBSL also investigates into any other complaint referred to it against any insurer, broker or agent. Out of 277 matters referred to and being reviewed by IBSL, 124 (44.76%) were settled/closed during the period. Out of the matters settled/closed, 84 disputes were relating to claims under insurance policies. Out of this amount, 24 claims were honoured by insurers upon the intervention of IBSL.

Out of 29 insurance companies (insurers) registered with the Board as at 30 June 2015, four are composite companies (dealing in both Long Term and General Insurance Businesses), 11 are registered to carry on Long Term (Life) Insurance Business and 14 companies are registered to carry on only General Insurance Business. Ceylinco Takaful Limited is prohibited from engaging in insurance business since 5 August 2009. AIG Insurance Ltd. has informed the Board of its intention to withdraw its operations from the Sri Lankan market and is on a runoff plan currently.

Fifty-seven insurance brokering companies, registered with the Board as at 30 June 2015, mainly concentrate in General Insurance Business. Total Assets of insurance brokering companies have increased to Rs. 3,568 million as at 30 June 2015 when compared to Rs. 3,182 million recorded as at 30 June 2014, reflecting a growth of 12.12% year-on-year.

www.ft.lk

No comments:

Post a Comment