Urgent reforms for revival of an economy showing signs of strain is the emphatic message from the International Monetary Fund (IMF) for Sri Lanka with the former’s approval of $ 1.5 billion cash support under a three year program.

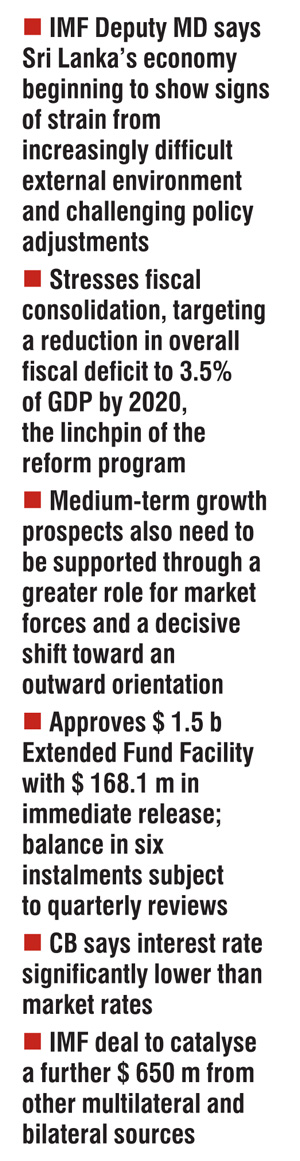

The IMF’s Executive Board on Saturday approved a 36-month extended arrangement under the Extended Fund Facility (EFF) with Sri Lanka for an amount equivalent to SDR 1.1 billion (about US$1.5 billion, or 185% of quota) to support the country’s economic reform agenda.

The decision by the Government to seek an EFF from the IMF stemmed from both external and domestic developments.

The IMF said the arrangement aims to meet balance of payments needs arising from a deteriorating external environment and pressures that may persist until macroeconomic policies can be adjusted. It is also expected to catalyze an additional US$650 million in other multilateral and bilateral loans, bringing total support to about $2.2 billion (over and above existing financing arrangements).

The IMF Executive Board’s decision will enable an immediate disbursement of SDR 119.894 million (about US$ 168.1 million), and the remainder will be available in 6 instalments subject to quarterly reviews.

The Central Bank said the interest rate applicable on the EFF, the basic rate of charge is equivalent to the SDR interest rate, which currently stands at 0.05% per annum, plus 100 basis points. Hence, the interest rate of the EFF facility is significantly lower than the prevailing market rates.

Following the Executive Board discussion on Sri Lanka, IMF Deputy Managing Director and Acting Chair Min Zhu said: “Despite positive growth momentum, Sri Lanka’s economy is beginning to show signs of strain from an increasingly difficult external environment and challenging policy adjustments. The new government’s economic agenda, supported by the Extended Fund Facility, provides an important opportunity to re-set macroeconomic policies, address key vulnerabilities, boost reserves, and support stability and resilience.”

“A return to fiscal consolidation, targeting a reduction in the overall fiscal deficit to 3.5% of GDP by 2020, is the linchpin of the reform program. Rebuilding tax revenues through a comprehensive reform of both tax policy and administration will be key in this regard, supplemented by steps toward more effective control over expenditures and putting state enterprise operations on a more commercial footing.

“Medium-term growth prospects also need to be supported through a greater role for market forces and a decisive shift toward an outward orientation. A clear commitment to exchange rate flexibility will enable adjustment to a shifting external environment while allowing the central bank to rebuild foreign exchange reserves and focus more closely on its key mandate of price stability. The economic program also supports the government’s objective of boosting competitiveness and greater integration with regional and global markets through comprehensive trade reform and improvements to the investment environment. Steadfast implementation of these reforms should strengthen Sri Lanka’s ability to attract investment, improve prospects for sustained medium-term growth, and reduce fiscal risks.”

“Medium-term growth prospects also need to be supported through a greater role for market forces and a decisive shift toward an outward orientation. A clear commitment to exchange rate flexibility will enable adjustment to a shifting external environment while allowing the central bank to rebuild foreign exchange reserves and focus more closely on its key mandate of price stability. The economic program also supports the government’s objective of boosting competitiveness and greater integration with regional and global markets through comprehensive trade reform and improvements to the investment environment. Steadfast implementation of these reforms should strengthen Sri Lanka’s ability to attract investment, improve prospects for sustained medium-term growth, and reduce fiscal risks.”In response to the request for an EFF by the Sri Lankan authorities, a team of IMF officials visited Sri Lanka in March/April 2016, and conducted several rounds of discussions with the Sri Lankan authorities. The discussions with the senior staff of the IMF were continued by the Sri Lankan delegation to the IMF during its Annual Meetings in April 2016. Subsequent to the successful completion of technical level negotiations, meeting of the recommended prior actions by the government, and the signing of the Letter of Intent (LOI) by Sri Lankan authorities in May 2016, the EFF was approved by the Executive Board of the IMF on 03 June 2016.

Program Summary

The proposed new IMF-supported program aims to provide a policy anchor for macroeconomic stability and structural reforms, while strengthening external resiliency in a challenging global environment.

The key objectives of the program relate to fiscal policy and the balance of payments, and measures to:

(a) implement a structural increase in revenues,

facilitating a reduction in the fiscal deficit;

(b) reverse the decline in central bank foreign exchange reserves;

(c) reduce public debt relative to GDP and lower

Sri Lanka’s risk of debt distress; and

(d) enhance public financial management and improve the operations of state owned enterprises.

The program also aims to transition toward inflation targeting with a flexible exchange rate regime and to promote sustainable and inclusive economic growth.

To achieve these objectives, the program would envisage implementation of a set of reforms under six pillars:

(i) Fiscal consolidation;

(ii) Revenue mobilisation;

(iii) Public financial management reform;

(iv) State enterprise reform;

(v) Transition to flexible inflation targeting under a flexible exchange rate regime; and

(vi) Reforms in the trade and investment regime.

Central Bank says IMF program will ensure high and inclusive growth

The Central Bank on Saturday said the IMF program and its benefits will help facilitate high and inclusive growth in Sri Lanka, enabling the exploitation of Sri Lanka’s economic potential.

“The outcomes of the EFF supported economic program will result in improving macroeconomic stability, bolster market confidence, enhance competitiveness and outward orientation and strengthening external resilience in a challenging global environment. This, in turn, will help facilitate high and inclusive growth in Sri Lanka, enabling the exploitation of Sri Lanka’s economic potential,” the Central Bank said in its statement.

It also said the approval of the EFF by the Executive Board of the IMF signals its support for the government’s economic reform agenda over the medium term.

According to the Central Bank the government plans to introduce fundamental and comprehensive reforms to tax policy and administration, which will ease the burden of public debt and the pressure on the BOP while providing fiscal space for the government’s key social and development spending programs.

Accordingly, a steady reduction of the overall budget deficit to 3.5 % of GDP is expected by 2020. The reform agenda also focuses on transforming State Owned Enterprises (SOEs) into commercially viable entities, underpinned by cost reflective pricing mechanisms and transparent governance. The gradual building up of foreign reserves and maintenance of inflation at mid-single digit level are also expected under the EFF supported economic program.

Other key structural reforms include trade facilitation through the reduction of protection and the pursuit of new trade agreements. In the meantime, the Central Bank is expected to move towards introducing flexible inflation targeting as its monetary policy framework supplemented by the continuation of the flexible exchange rate policy.

The approval of the EFF is expected to attract additional funds from other multilateral and bilateral sources for the successful implementation of the reform agenda of the government.

The decision by the Sri Lankan authorities to seek an EFF from the IMF stemmed from both external and domestic developments. Externally, there has been renewed global economic uncertainty, particularly with the slowdown of the Chinese economy, fears of a Britain’s exit from the European Union, and adverse geopolitical developments in the Middle East. At the same time, the monetary policy normalisation in the United States prompted an outflow of funds from emerging market and developing economies, including Sri Lanka. Despite the low level of international commodity prices, the slowdown in the growth of demand in Sri Lanka’s traditional export markets and capital outflows exerted significant pressure on the external sector generating an overall deficit in the BOP. The government and the Central Bank adopted corrective measures to help dampen the pressure on the BOP and the domestic foreign exchange market. In particular, greater flexibility was allowed in the determination of the exchange rate, new macroprudential regulations were introduced as selective demand management instruments and monetary policy was tightened commencing end 2015.

Nevertheless, the structural issues in the fiscal and external sectors persisted, and the government was of the view that an IMF support would further strengthen the government’s efforts to address structural issues.

www.ft.lk

No comments:

Post a Comment